On January 29, 2026, Deputy Governor Pham Tien Dzung of the State Bank of Vietnam (SBV) held a meeting with a delegation from SEA Group to exchange views and discuss orientations for the development of digital financial services in Vietnam.

Deputy Governor Pham Tien Dzung speaks at the meeting

At the meeting, Deputy Governor Pham Tien Dzung acknowledged SEA Group’s insights, experience, and proposals, and highly appreciated the Group’s cooperation and sense of responsibility in researching and developing digital financial solutions in a safe and sustainable manner. The Deputy Governor emphasized that the SBV consistently supports and facilitates initiatives in the finance and banking sector that align with the Government’s policies on promoting cashless payments, national digital transformation, and financial inclusion, with the aim of enabling all Vietnamese citizens to access comprehensive financial services.

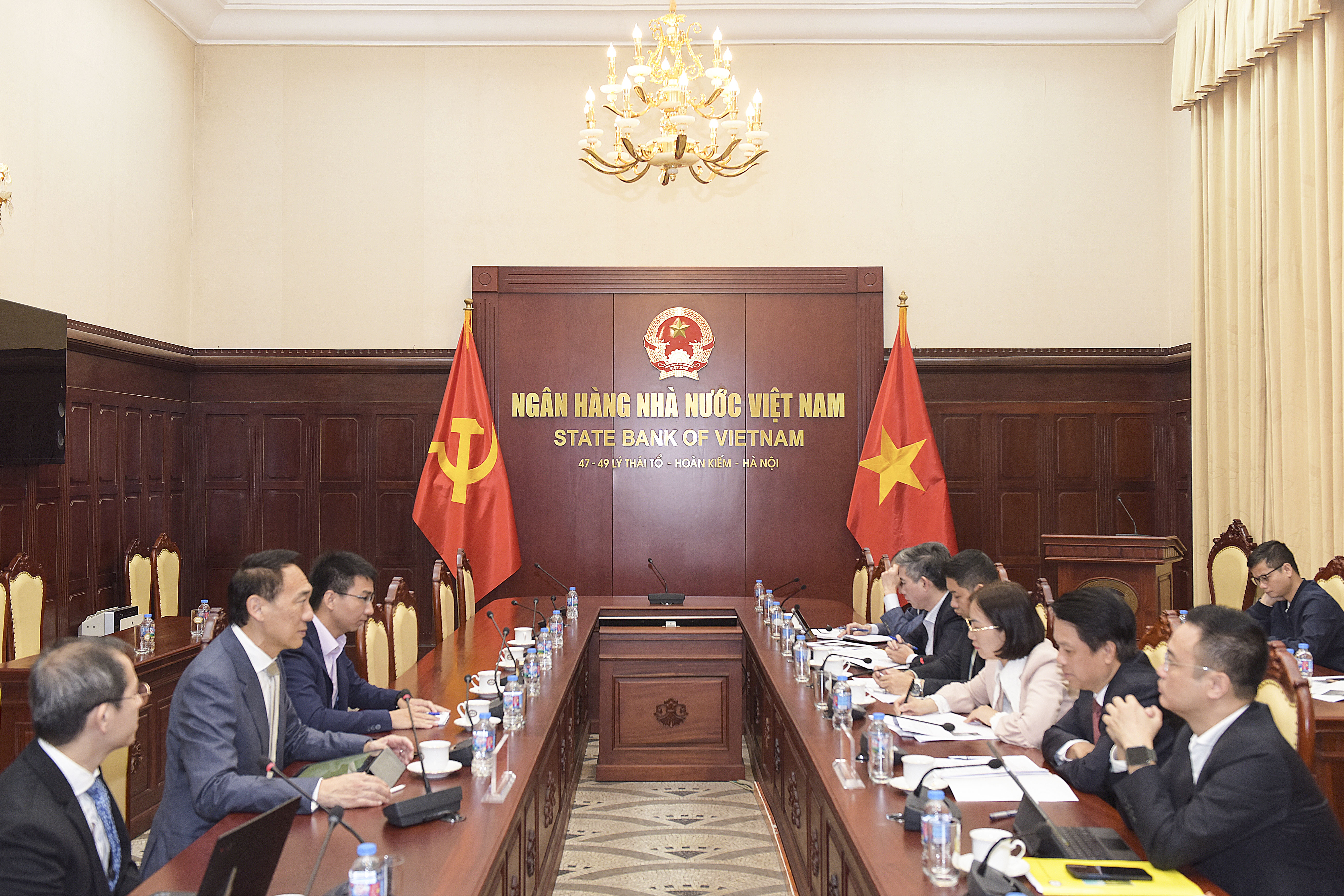

Overview of the meeting

The Deputy Governor also noted that the implementation of digital financial services and models must be carried out prudently, ensuring safe and sound banking operations, effective risk management, compliance with Vietnamese laws and regulations, and alignment with the domestic market conditions. In this spirit, the SBV stands ready to continue the dialogue and cooperation with enterprises to research and improve the legal frameworks, thereby creating a favorable environment for the healthy development of digital financial services.

Mr. Bruce Liang, Chief Executive Officer for Strategy, Digital Financial Services (Monee), SEA Group, speaks at the meeting

For his part, Mr. Bruce Liang, Chief Executive Officer for Strategy, Digital Financial Services (Monee) of SEA Group, shared the Group’s experience in researching and implementing digital financial models in several countries across the region and worldwide. He also expressed his wish to exchange views and seek consultation from the SBV regarding the potential provision of consumer lending services and other digital financial initiatives, aiming to promote innovation and enhance digital financial capacity for individuals and businesses, especially underserved customers.

Through this meeting, the two sides strengthened the information exchange and gained a better understanding of the SBV’s regulatory orientations, as well as SEA Group’s digital finance development strategy, thereby contributing to the healthy and sustainable development of Vietnam’s finance and banking system.